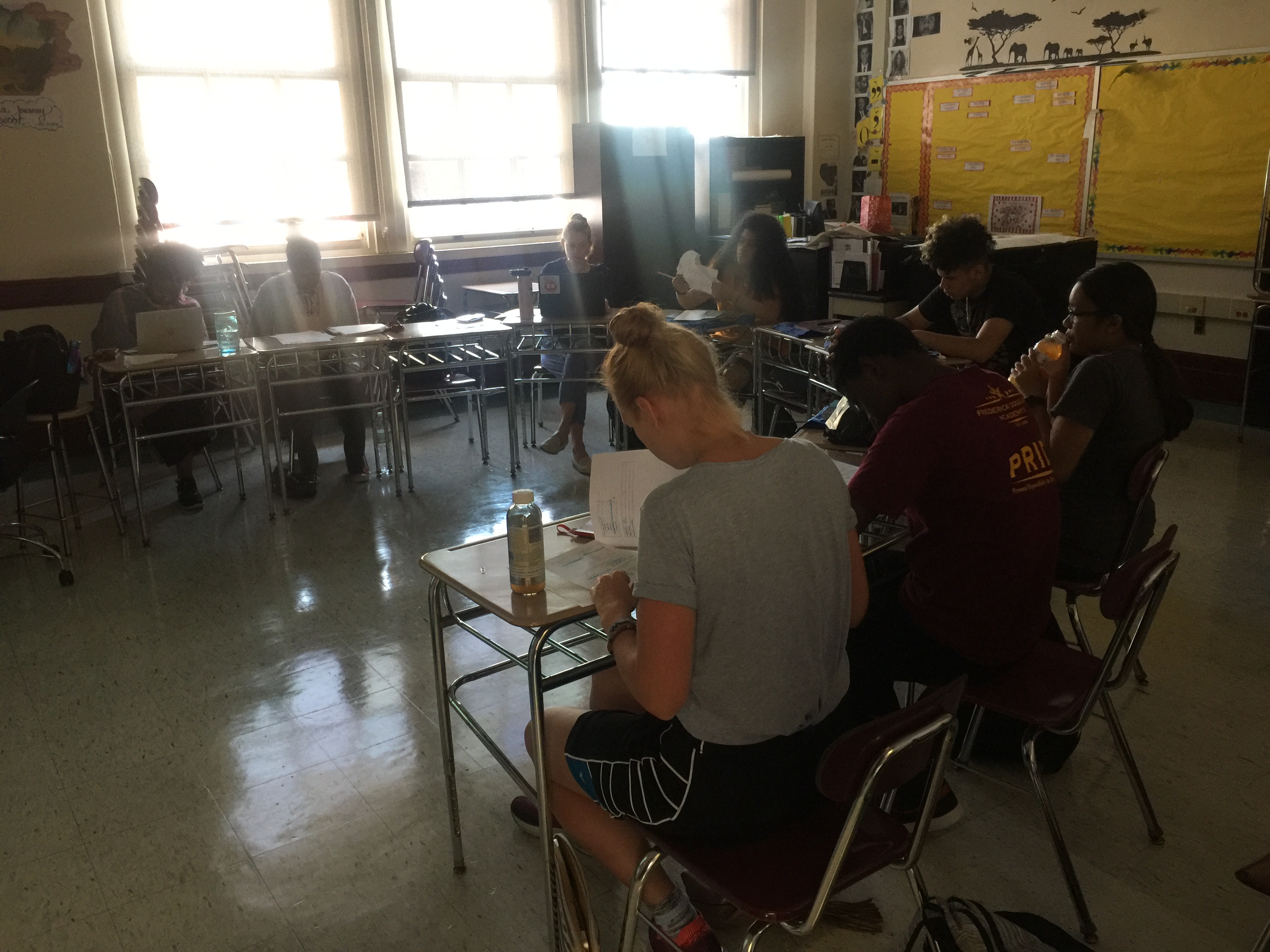

GAC Financial Literacy Youth Summer Workshop @ Frederick Douglass Academy II

Here’s what onsite managers from Columbia University School of Social Work Achievement Initiative said about our workshop:

“Students were engaged through out the entire workshop, evident in the number of questions asked by students. Our students don’t ask questions if they are not engaged.”

“Students really liked the financial literacy booklets!”

“We (onsite managers) were also engaged. Very knowledgeable”

Harlem, New York – Students attending the Achievement Initiative at Frederick Douglass Academy II learned valuable lessons about personal financial management and chasing their dreams. The three-hour GAC workshop included video presentations, engaging discussions and eye opening exercises that painted each student a personal portrait of their dream and real world scenarios that could lead to successful adult transformations.

By round of applause – Who likes money!!?? Has anyone here taken classes on personal financial management? How many here are working a summer job?

Have your parents or someone close to you taught you the basics of spending money wisely?

The truth is just 17 states require students to learn personal financial management and the standards vary widely. Case in point, many of the fifteen and sixteen year-olds in the workshop had money to spend but little to no education on how to spend it.

Like driving a car without a license, it’s extremely dangerous to learn these lessons the hard way!

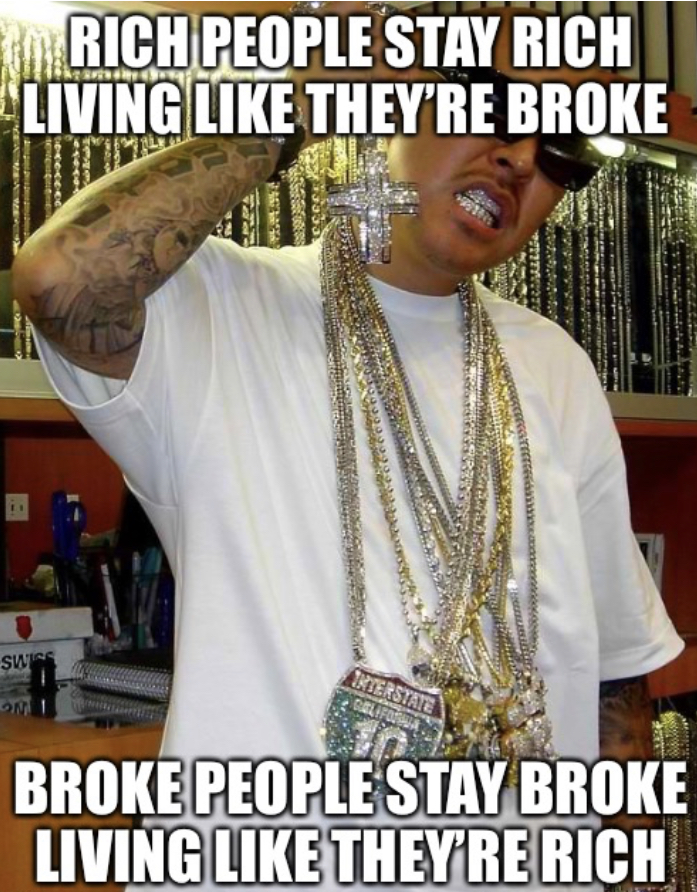

Without some basic smarts, students will fall prey to marketers who’s number one goal is to make them feel good about becoming a slave to debt.

Our mission is to break the cycle, to dispel the collective notion that money is disposable and the fantasy that there will always be more.

Decisions have consequences! Spending money with no plan for saving, or paying money on top of money you have already spent are not the wisest ones.

Breaking the cycle also means providing alternatives, not just scare tactics. The workshop provides students with real world scenarios that can have a lasting impact on critical decision making. What we call being “young-money wise” or “young money-wise”, terms that describes being young and smart about money or older and seeking further money wisdom, respectively.

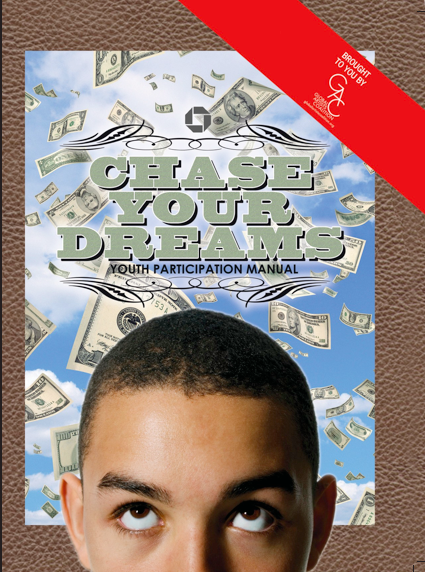

Originally created through a grant from JPMorgan Chase Foundation in partnership with Hot 97, Kiss FM and Chase Bank to deliver financial literacy to at-risk communities.

Originally created through a grant from JPMorgan Chase Foundation in partnership with Hot 97, Kiss FM and Chase Bank to deliver financial literacy to at-risk communities.

Workshop Sessions I&II: Basic Banking

Key lessons:

Video presentation and discussion on how managing personal finances is like running a small business, with a person’s chosen lifestyle the equivalent of overhead costs. “Excessive” overhead is the cause of many businesses failures because the business is spending more money than it earns. In the case of personal finances, savings are the equivalent of profits, with excessive lifestyle choices leading to a negative balance.

How many of you were considering a career, but realized the income fell short of the lifestyle score you received in the exercise? What might you do next?

In addition to budget management, students considered alternative income streams that did not require their direct involvement. Exercises that identified “passive income” streams from chosen careers, education levels and business experience.

Workshop Session III: Chase Your Dreams

Key lessons:

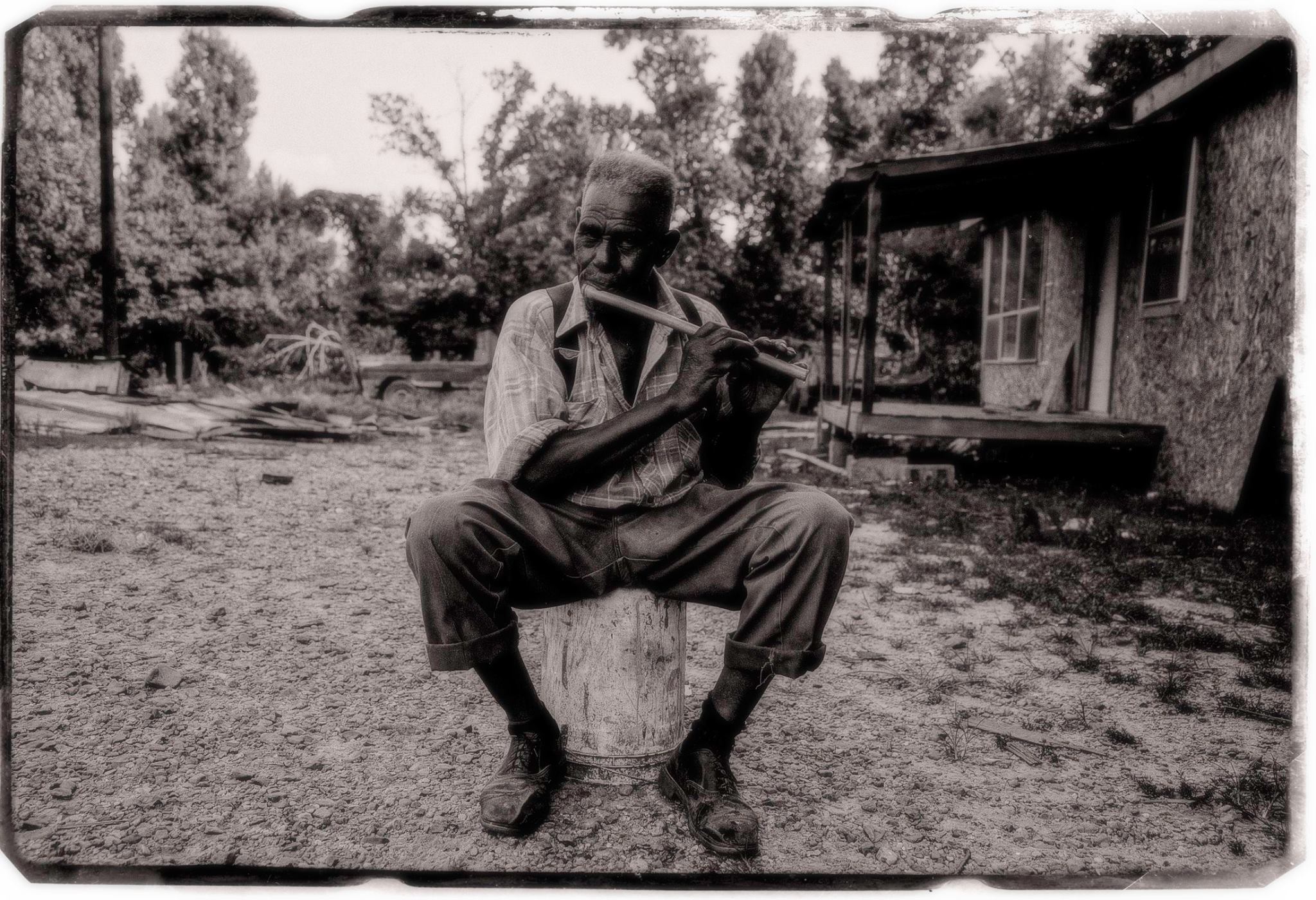

Video presentation and discussion on chasing your dreams and how the science of believing actually works, including a demonstration of the placebo effect. Followed by a career discovery talk from a keynote guest speaker and a confidence building exercise that turned what students enjoy doing into fulfilling careers and businesses.

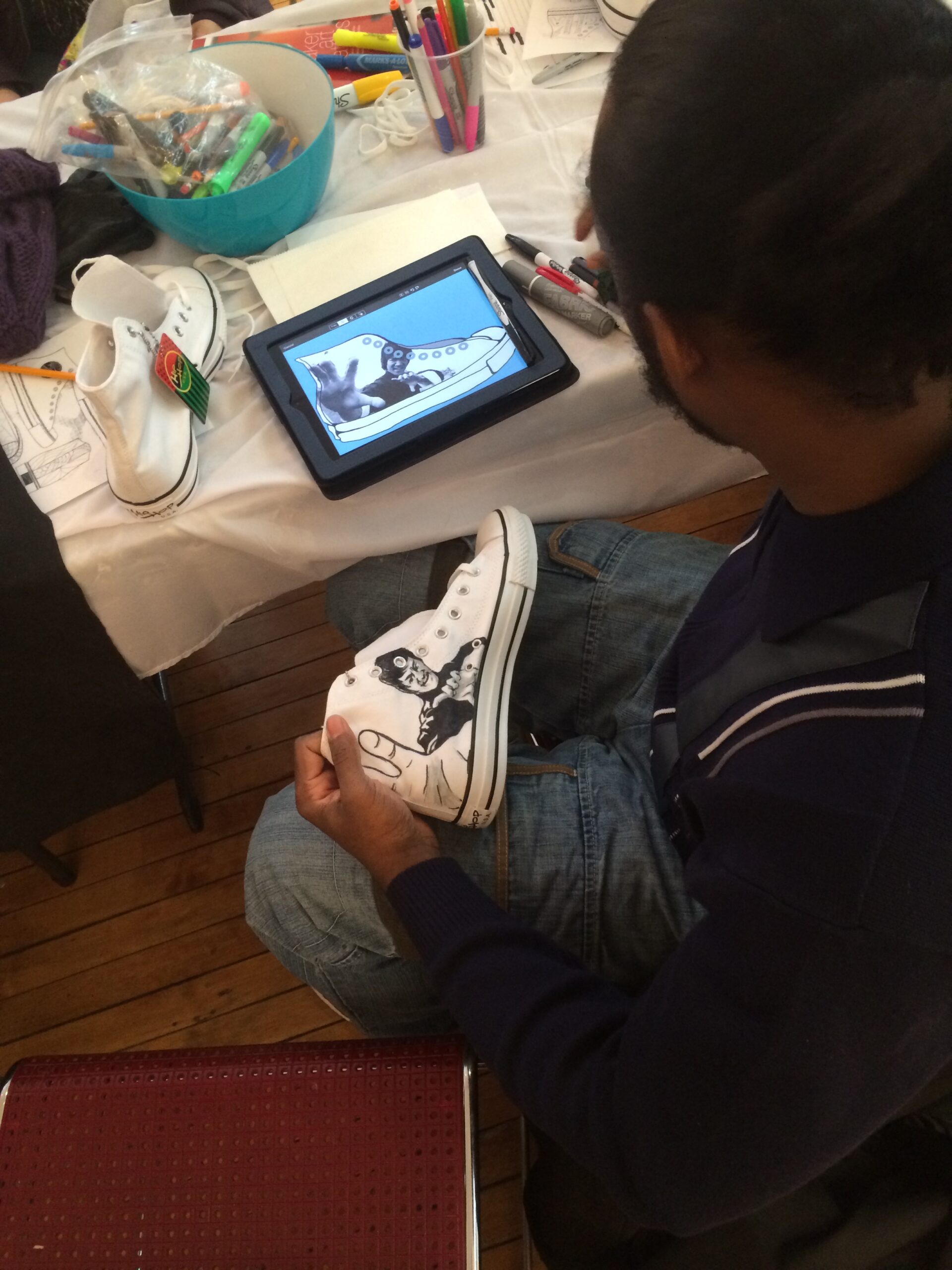

Real World Career Discovery: Meet Paul Edwards, Illustrator/Graphic Designer/Educator

It’s not enough to dream, students must also fulfill the plan. Think through all the details, acquiring the skills, education and experience that the dream requires. If something was not working, to try another approach.

So, what does it mean to chase your dreams and be young-money wise? It means students are ahead of the game when it comes to personal financial management and dream fulfillment!

For more information on upcoming live workshops or to enroll in the online course