Top Ten Money Memes You Need To Know To Be Young And Money Wise

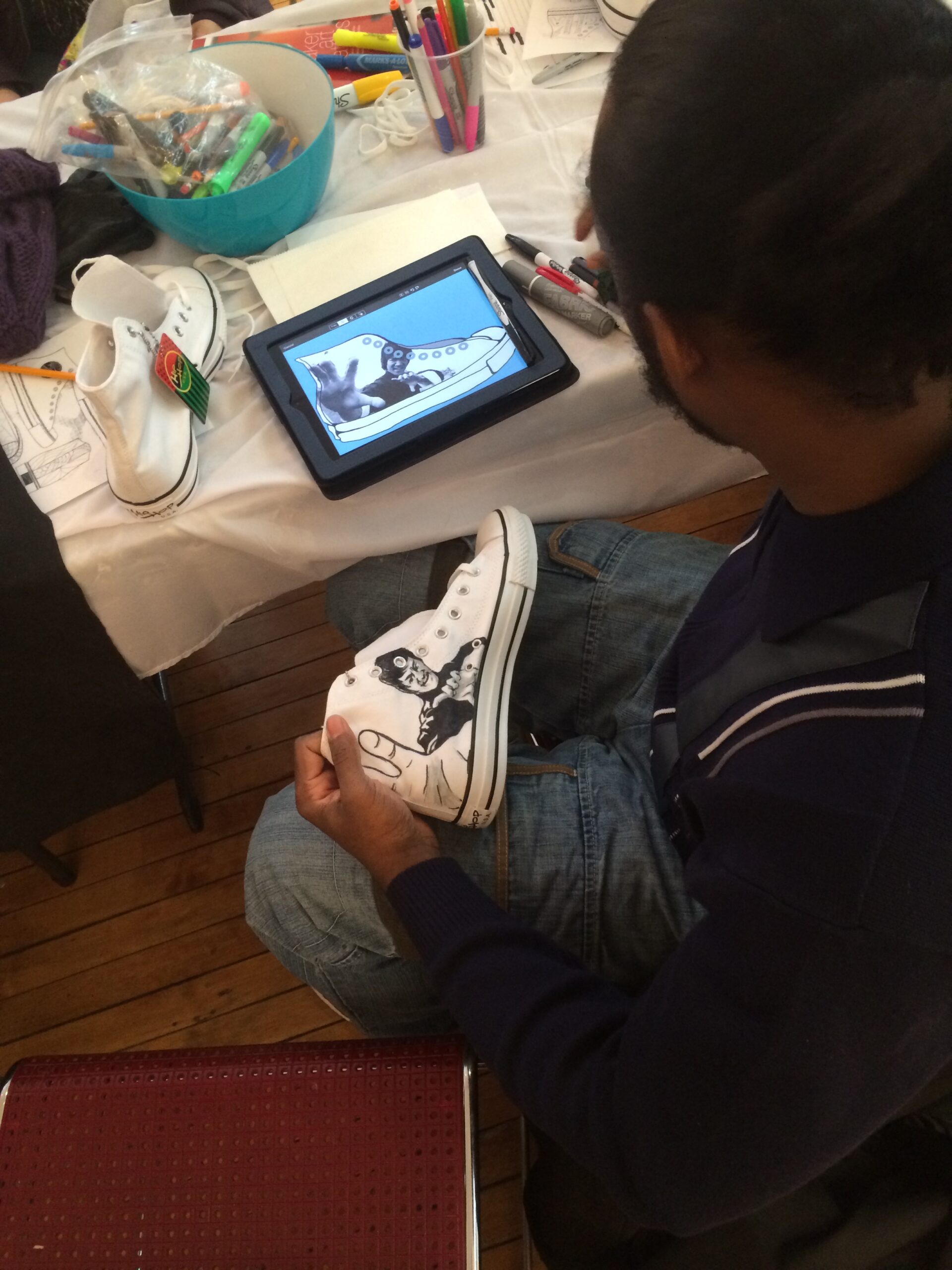

Let’s face it, it’s no fun being broke and it doesn’t help matters when we hear songs on the radio or see music videos about the cribs artists’ own, the cars they buy, and the vacations they take. But where does the fantasy end and the reality begin? Hip Hop is entertainment and we come to realize that these larger-than-life characters that appear to spend, spend, spend — on the biggest houses, the most-outlandish jewelry, the most expensive, elaborate shoes – don’t own any of it. Not all entertainers are rich and not all individuals with modest incomes are broke. The lesson learned is that there is nothing wrong with buying a gold chain, so long as it is not the only money you have.

Unless you been armed with some basic knowledge, your financial situation can quickly turn ruinous. Here’s our top ten list of money memes a young person should know on the path to being young and money wise.

(10)

Managing personal finances is like running a small business and your chosen lifestyle is the equivalent of overhead costs. Excessive overhead costs are the cause of many business failures because the business is in effect spending more money than it earns. In the case of personal finances, your profits are your personal savings and your lifestyle choices will put you either in the black, as in profits, or the red, as in the hole.

(9)

Some who live paycheck to paycheck are unable to save because their lifestyle choices have led them to bad decisions. But it’s never too late to change, starting today. Try selecting a less pricey pair of sneakers that you know will wear out in a few short months, anyway. Or, not funding pizza parties with friends on your personal credit card!

(8)

A new survey of more than 1,800 people from the American Express Spending and Savings Tracker found that 43 percent of Americans keep their savings in cash. And an alarming 53 percent of those cash-hoarders “plan to hide bills in a secret location at home.” While the survey itself doesn’t explain why, it’s reasonable to assume that at least some of these savers feel safer putting their money where they can see it.

If your young-money wise, you know that keeping large sums of cash at home makes you extremely vulnerable. You could be robbed, have a flood or fire, or find out your pet loves to eat green things. Adults who make wiser choices keep their money in the bank. Unless you have extenuating circumstances, like say running a drug cartel or something else nefarious, avoiding the bank is usually a bad idea. Money stored in a Federal Deposit Insurance Corporation (FDIC) is insured up to $250,000 per person, meaning money deposited in accounts like checking, savings, and retirement savings are guaranteed and protected by the FDIC

(7)

Giving up impulse shopping in the short term to be successful in the long term is part of being young-money wise. If you cut back each month on going out to eat, or to the movies, or shopping until you drop – you will be spending less and giving yourself more opportunities to save.

(6)

Living beyond your means is pretty easy to do, especially when you put it all on a credit card. People spend more with plastic because it doesn’t feel like real money. So if your carrying a balance month to month, you’re either spending more than you can afford or not living like your young-money wise. Pro tip: put your balance back in the black by doubling or tripling down on minimum payments over the next few months.

(5)

If you go out to lunch Monday through Friday for a year, you might drop $10-15 per meal. This adds up to $75 week and $3,900 per year! If you go out for dinner two or three times a week, your bleeding even more. And if your wondering whether “takeout or delivery” counts as “dining out”, it does. If your young-money wise , you know that delivery charge minimums and surcharges add up to eating out.

Spending $50 a week on restaurant food or $2,500 per year is close to the national average. But if your young-money wise, you know this still adds up to nearly half the average American’s annual food budget.

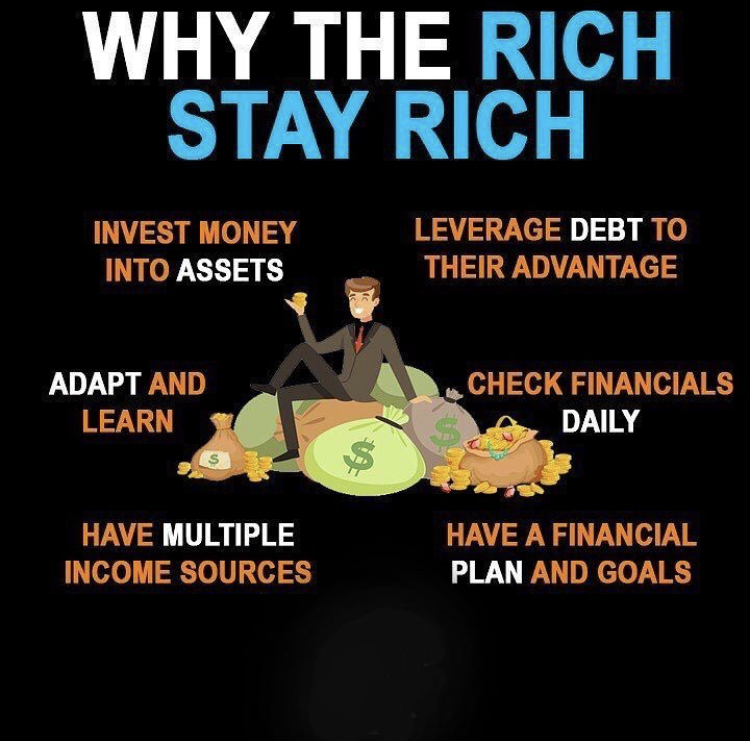

(4)

The rich have long-term plans and stick to them. The rich also understand that the best investments often play out over time. Long-term planning takes discipline and does not happen spontaneously. Goal setting is also an ongoing activity. The rich know they need to remind themselves to stay on track. The rich don’t just write down their goals and put them away, they make regular appointments to review those goals and measure performance.

(3)

Develop a Savings Plan. Pay yourself first. List savings as a fixed item in your spending plan. Use automatic savings methods. Save all or part of a certain type of income. Establish savings buckets and watch them closely.

(2)

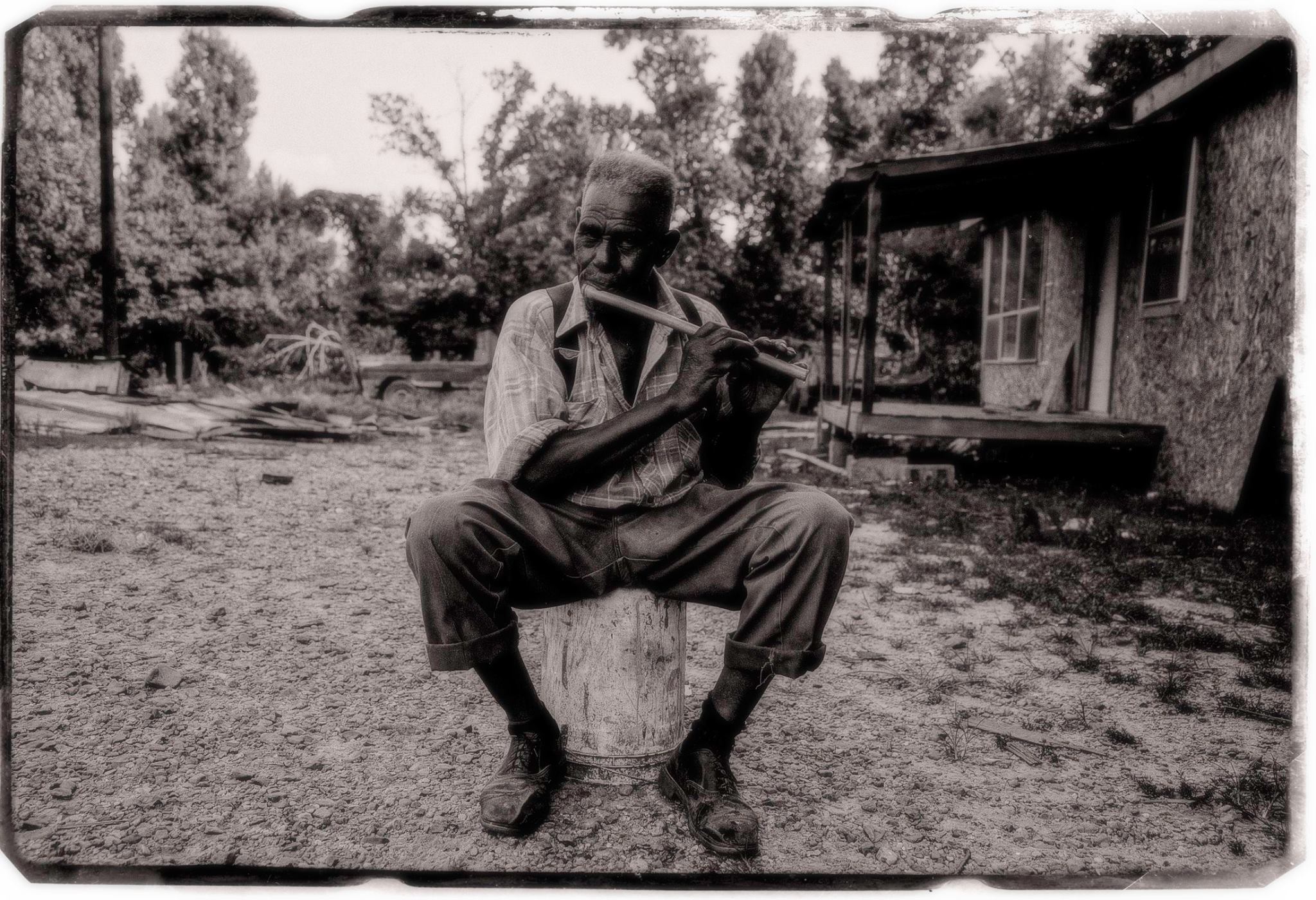

A mentor can advise you on what not to do before making the mistake yourself. They can help you take control of your health, wealth and happiness. Break the cycle of bad habits you might have learned from those close to you by finding a mentor. The mentor is a role model – someone you look up to and want to emulate for all the right reasons. The mastery of money and finance is just one of many areas they can help. Pro tip: Choose your mentors carefully.

(1)

The number one investment is in yourself! This includes increasing your level of education and experience in your chosen career, profession or business. Financial Investment is also key, and that includes personal savings, access to loans or capital awarded through maintaining a good credit history. It also means finding an investor that believes in your ability to capitalize on a well though out business venture.